Okay, consider me your crypto-savvy financial mentor. Let's explore how stay-at-home moms can navigate the digital asset landscape to generate income and build a financial future.

Being a stay-at-home mom is a demanding job in itself, requiring immense dedication and often leaving little time for traditional employment. However, the digital age offers numerous opportunities for generating income without the need for fixed hours or commuting. Crypto investment, though perceived as complex, presents a viable option if approached with knowledge, strategy, and a firm grasp on risk management. It's not about getting rich quick; it's about building a portfolio with calculated risks and a long-term perspective.

The first step is understanding the crypto market. Forget the hype and sensationalist headlines. Real learning involves in-depth research. Start with Bitcoin, the original cryptocurrency. Understand its underlying technology, blockchain, and its role as a decentralized store of value. Then explore Ethereum, the platform that enables decentralized applications (dApps) and smart contracts. These two form the bedrock of the crypto ecosystem, and a solid understanding of them is crucial.

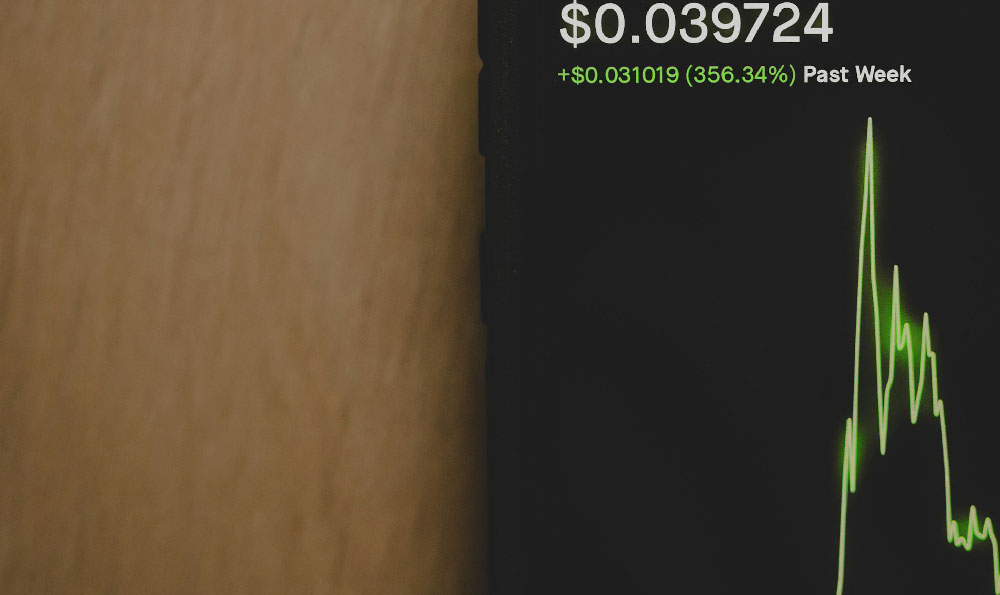

Next, consider your risk tolerance and investment horizon. Are you comfortable with high volatility, or do you prefer a more conservative approach? How long are you willing to hold your investments before expecting returns? Answering these questions will dictate the types of cryptocurrencies you invest in and the strategies you employ. For example, if you are risk-averse and have a long-term horizon, Bitcoin and Ethereum, despite their volatility, might be suitable candidates for a "buy and hold" strategy. This involves purchasing these cryptocurrencies and holding them for the long term, regardless of short-term price fluctuations.

However, diversification is key. Don't put all your eggs in one basket. Explore other cryptocurrencies with strong fundamentals and promising use cases. Research altcoins (alternative cryptocurrencies) that address specific needs or offer innovative solutions. Look into decentralized finance (DeFi) projects, which aim to revolutionize traditional finance through blockchain technology. Consider investing in projects related to the metaverse or Web3, the next iteration of the internet.

Crucially, do your own research (DYOR). Don't blindly follow recommendations from online influencers or social media groups. Develop your own analytical skills. Learn to read whitepapers, the technical documents that outline the goals and functionalities of a cryptocurrency project. Understand the team behind the project, their track record, and their commitment to the long-term success of the project. Evaluate the project's community, its level of engagement, and its overall sentiment.

Technical analysis is another valuable skill to acquire. This involves studying price charts and using technical indicators to identify potential entry and exit points. Learn about moving averages, relative strength index (RSI), and other indicators that can help you gauge market sentiment and predict price movements. While technical analysis is not foolproof, it can provide valuable insights and help you make more informed investment decisions.

Beyond simply buying and holding, there are other ways to generate income with cryptocurrency. Staking involves holding certain cryptocurrencies in a wallet to support the network's operations and earn rewards in return. Think of it as earning interest on your crypto holdings. Yield farming involves providing liquidity to decentralized exchanges (DEXs) and earning rewards in the form of transaction fees and native tokens. However, staking and yield farming can be more complex and involve higher risks, so it's essential to thoroughly research the projects you're participating in.

Another avenue to explore is crypto-related content creation. If you have a knack for writing, create a blog or start a YouTube channel where you share your knowledge and insights about the crypto market. You can earn income through advertising, sponsorships, or affiliate marketing. If you're skilled in graphic design or video editing, offer your services to crypto startups or projects.

However, let's address the elephant in the room: risks. The crypto market is highly volatile, and prices can fluctuate dramatically in short periods. You could lose a significant portion of your investment if you're not careful. Be prepared for losses and never invest more than you can afford to lose.

Security is paramount. Protect your crypto assets by using strong passwords, enabling two-factor authentication (2FA), and storing your cryptocurrencies in secure wallets. Consider using a hardware wallet, a physical device that stores your private keys offline, making it more resistant to hacking attempts. Be wary of phishing scams, which are designed to steal your login credentials or private keys. Never click on suspicious links or share your sensitive information with anyone.

Tax implications are also important to consider. Consult with a tax professional to understand the tax regulations in your jurisdiction and ensure you're complying with all applicable laws.

Finally, remember that the crypto market is constantly evolving. Stay up-to-date with the latest news and developments. Continuously learn and adapt your strategies as the market changes. Join online communities, attend conferences, and network with other crypto enthusiasts.

Success in crypto investing requires patience, discipline, and a willingness to learn. It's not a get-rich-quick scheme, but a long-term investment strategy that can potentially generate significant returns. As a stay-at-home mom, you have the flexibility and the time to dedicate to learning and mastering the crypto market. With careful planning, diligent research, and a focus on risk management, you can leverage the power of cryptocurrency to achieve your financial goals and secure your family's future. Embrace the learning process, stay informed, and invest responsibly.