Cryptocurrency investment has become a focal point for many seeking financial growth in the digital age, yet navigating this complex landscape demands a combination of strategic insight, technical acumen, and a balanced approach to risk. To truly succeed in this field, investors must cultivate a deep understanding of market dynamics, leverage analytical tools effectively, and implement safeguards that align with their long-term goals. The path to profitability in crypto is not linear; it requires adaptability, patience, and a commitment to continuous learning. Let's explore how these elements intertwine to create a robust framework for informed decision-making.

Understanding Market Trends

The cryptocurrency market operates on cycles, driven by factors such as technological advancements, regulatory changes, macroeconomic shifts, and public sentiment. For instance, the rise of institutional adoption often signals a bullish trend, while geopolitical tensions or crackdowns on digital assets can spark volatility. Staying abreast of these trends is crucial for identifying opportunities and anticipating risks. Investors should monitor news cycles, track the adoption rates of blockchain technologies, and analyze the correlation between market sentiment and price movements. Tools like Twitter, industry reports, and market analysis platforms provide valuable insights, but they must be cross-referenced to avoid misinformation. A nuanced approach to interpreting trends allows investors to spot emerging trends early, such as the growing interest in decentralized finance (DeFi) or the potential impact of central bank digital currencies (CBDCs) on traditional markets.

Key Technical Indicators

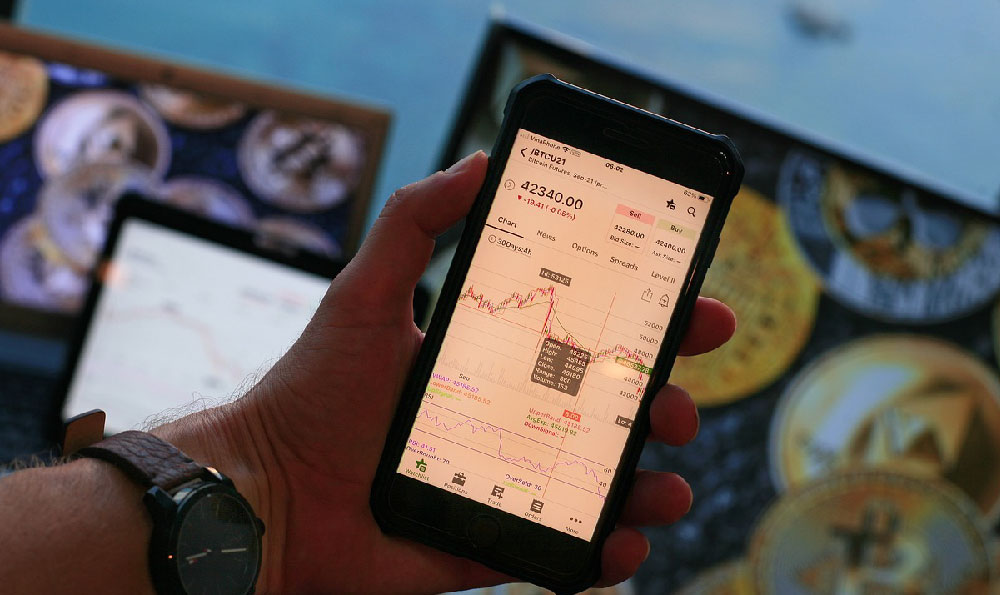

While market trends offer context, technical analysis provides actionable data. price action, volume, and chart patterns are fundamental to this process. For example, a bullish trendline break accompanied by increased trading volume can confirm a potential upward movement, while a bearish divergence in the Relative Strength Index (RSI) might indicate overbought conditions. Investors should also pay attention to moving averages, such as the 50-day and 200-day lines, which can help identify support and resistance levels. However, technical indicators are not foolproof; they must be interpreted within the broader market narrative. Overreliance on a single indicator can lead to misjudgments, underscoring the need for a diversified analytical strategy. Combining multiple indicators with fundamental analysis creates a more comprehensive view of market behavior.

Investment Strategies for Growth

A successful cryptocurrency strategy hinges on alignment with personal financial objectives and risk tolerance. For those with a long-term horizon, dollar-cost averaging (DCA) offers a disciplined approach to accumulating assets over time. Conversely,短线 traders may employ trend-following strategies, entering positions as prices rise and exiting when they show signs of reversal. Position sizing is another critical component—allocating capital proportionally to the risk of each trade ensures that no single investment jeopardizes the overall portfolio. Diversification across different asset classes, such as stocks, bonds, and cryptocurrencies, further mitigates risk. However, over-diversification can dilute returns, so a balance must be struck. Investors should also remain open to adapting their strategies as market conditions evolve, staying flexible to respond to unprecedented developments like regulatory interventions or technological breakthroughs.

Risk Management Techniques

The volatile nature of cryptocurrency markets necessitates rigorous risk management. Setting stop-loss orders is a common practice, helping to limit potential losses by automatically triggering a sale when prices fall below a specified threshold. Conversely, take-profit orders lock in gains at predetermined levels. Investors must also assess the liquidity of their chosen assets, as illiquid cryptocurrencies can lead to significant price slippage during large trades. Diversification, as mentioned earlier, plays a dual role in risk management by reducing exposure to any single asset. Additionally, maintaining a cash reserve ensures that investors can capitalize on unexpected opportunities without overextending their capital. However, risk management is not limited to predefined strategies; it requires constant vigilance. For example, monitoring news related to regulatory changes or security breaches in exchanges can help investors anticipate and mitigate risks proactively.

The Role of Continuous Education

In the ever-evolving world of cryptocurrency, continuous learning is a cornerstone of success. The market is influenced by technological innovations, regulatory frameworks, and macroeconomic factors that require regular updates. Investors should engage with reputable sources, such as academic journals, industry newsletters, and forums, to stay informed. Personal development through courses or certifications can also enhance decision-making skills, particularly for those new to the field. However, overreliance on education without practical application can lead to stagnation. A balance must be struck between studying theoretical frameworks and engaging in real-world trading. Additionally, investors should remain cautious of information overload, focusing on high-quality data that aligns with their strategic goals.

The Psychological Aspect of Investing

Beyond technical and financial considerations, the psychological dimension of investing cannot be overlooked. Emotions such as fear and greed often drive market behavior, leading to irrational decisions. Investors must cultivate discipline, adhering to their strategy even during periods of extreme volatility. For example, avoiding the temptation to chase rapid gains or panic during dips is essential for long-term success. The ability to remain calm and objective in uncertain conditions distinguishes seasoned investors from novices. Additionally, maintaining a long-term perspective helps counteract short-term fluctuations, ensuring that decisions are based on fundamentals rather than fleeting market noise.

Innovations and Emerging Opportunities

The cryptocurrency landscape is continuously evolving, with innovations such as stablecoins, NFTs, and cross-chain technologies reshaping the market. These innovations present new opportunities for growth, particularly in sectors like DeFi and blockchain infrastructure. For instance, stablecoins have become essential tools for managing volatility, while NFTs have opened new avenues for investment in digital collectibles. Investors should remain open to exploring these spaces, but they must do so with caution. Understanding the underlying technology, legal implications, and market demand is crucial before entering any new asset class. Additionally, keeping an eye on emerging projects and their potential for scalability and adoption can uncover hidden gems in the market.

A Holistic Approach to Success

Ultimately, success in cryptocurrency investment requires a holistic approach that integrates market analysis, technical expertise, risk management, and psychological discipline. By aligning these elements with personal goals and remaining adaptable to changing conditions, investors can navigate the complexities of this market with confidence. However, the journey is fraught with challenges, from market volatility to regulatory uncertainty. Recognizing these challenges and developing strategies to address them is essential for sustaining growth. The future of cryptocurrency investment is bright, but it demands a thoughtful and balanced approach that prioritizes both innovation and caution. Those who embrace this mindset will not only thrive in the short term but also build a resilient foundation for long-term success.