Unlocking the secrets to rapid wealth accumulation is a pursuit that captivates many. While the allure of "getting rich quick" schemes is strong, a more realistic and sustainable approach involves understanding the landscape of various options and making informed decisions aligned with your individual circumstances. It's important to acknowledge that genuine, ethical wealth creation usually necessitates a blend of strategic planning, diligent effort, and a degree of calculated risk.

One avenue frequently explored is the realm of active income generation. This involves leveraging your existing skills or acquiring new ones to provide services or products in high demand. Consider freelancing platforms, where you can offer services like writing, graphic design, web development, or virtual assistance. The advantage here is the immediate return on your time and effort. The income potential is directly proportional to your skill level, marketing acumen, and the demand for your services. Building a strong online presence and cultivating positive client relationships are crucial for sustained success in this domain. Another path within active income is consulting. If you possess specialized knowledge in a particular industry, offering your expertise as a consultant can be highly lucrative. Companies are often willing to pay substantial fees for expert advice that can improve their operations, strategy, or profitability. Building a credible brand and demonstrating a track record of success are essential for attracting clients in this field.

Beyond active income, the world of investments presents a diverse range of opportunities for accelerating wealth accumulation. Real estate, for example, can be a powerful wealth-building tool, but it also requires significant capital and a thorough understanding of the market. Investing in rental properties can generate passive income through rental payments, and the property itself can appreciate in value over time. However, real estate investment also involves responsibilities such as property management, tenant relations, and dealing with maintenance issues. A deep understanding of local market trends, property valuation, and financing options is crucial for making sound real estate investments.

The stock market offers another avenue for potential rapid growth, but it also carries a higher degree of risk. Investing in individual stocks can lead to substantial gains if you choose wisely, but it also exposes you to the risk of significant losses. Diversification is key to mitigating this risk. Spreading your investments across different sectors and asset classes can help to cushion your portfolio against market volatility. Exchange-Traded Funds (ETFs) and mutual funds offer a convenient way to achieve diversification without having to select individual stocks. These investment vehicles pool money from multiple investors to purchase a basket of assets, providing instant diversification. A crucial aspect of stock market investing is conducting thorough research on the companies you are investing in. Understanding their financial performance, competitive landscape, and growth prospects is essential for making informed investment decisions.

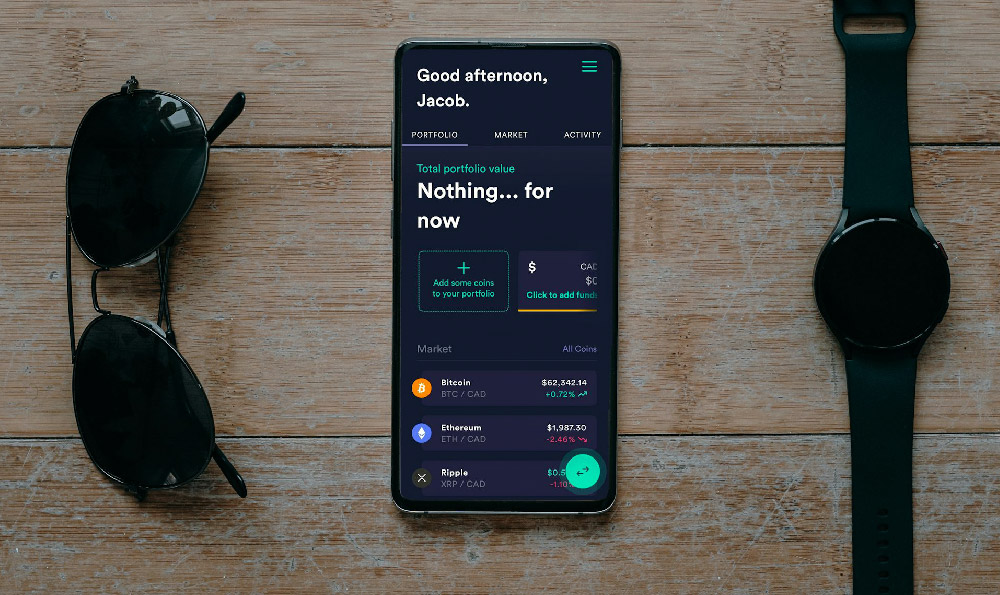

Beyond traditional investments, exploring alternative assets can offer unique opportunities for high returns. Cryptocurrency, for example, has gained significant attention in recent years, with some cryptocurrencies experiencing explosive growth. However, the cryptocurrency market is highly volatile and speculative, and it is important to approach it with caution. Understanding the underlying technology and the potential risks associated with different cryptocurrencies is crucial before investing. Other alternative assets include fine art, collectibles, and precious metals. These assets can offer diversification and potential for appreciation, but they also require specialized knowledge and may be less liquid than traditional investments.

Starting a business is arguably one of the most impactful ways to rapidly increase wealth. A successful business can generate substantial profits and create significant value over time. However, entrepreneurship also involves significant risks and challenges. Developing a solid business plan, securing funding, building a strong team, and effectively marketing your product or service are all crucial for success. Furthermore, entrepreneurial ventures often require significant personal investment in terms of time, energy, and resources. Identifying a market need, developing a unique value proposition, and creating a scalable business model are key factors that contribute to a successful entrepreneurial journey.

Another often-overlooked strategy is focused skill development combined with aggressive negotiation for salary increases or job hopping. Mastering a highly sought-after skill, particularly in fields like technology or data science, significantly increases your earning potential. Consistently upskilling and staying abreast of industry trends are essential for maintaining a competitive edge. Simultaneously, proactively seeking out opportunities for advancement within your current company or exploring higher-paying positions at other organizations can accelerate your income growth trajectory. Documenting your achievements and quantifying your contributions to your company's success are valuable assets when negotiating salary increases or seeking new employment.

It’s important to note that any strategy promising “fast” money should be carefully scrutinized. Be wary of schemes promising guaranteed returns or requiring upfront fees. A healthy dose of skepticism is warranted when encountering investment opportunities that seem too good to be true. Thoroughly research any investment opportunity before committing your money, and consult with a qualified financial advisor if you have any doubts.

Ultimately, achieving rapid wealth accumulation is a multifaceted endeavor that requires a combination of strategic planning, disciplined execution, and a willingness to take calculated risks. There's no single "best" option; the most effective approach depends on your individual circumstances, risk tolerance, and financial goals. By carefully considering your options, developing a sound financial plan, and staying informed about market trends, you can significantly increase your chances of achieving your financial aspirations. Remember that consistent effort, continuous learning, and a long-term perspective are essential ingredients for building sustainable wealth.