In the dynamic world of real estate, where opportunities and challenges intertwine, success hinges on a blend of strategic acumen, technological adaptation, and a keen understanding of market currents. For agents aspiring to thrive and generate substantial income, the key lies not merely in listing properties or facilitating transactions, but in harnessing the evolving landscape of digital assets to enhance both profitability and risk mitigation. As the market continues to fluctuate due to economic shifts, policy changes, and emerging technologies, a forward-thinking approach is essential. By integrating innovative tools and methodologies, agents can position themselves not only to capitalize on traditional assets but also to explore the potential of digital solutions that may redefine industry norms.

The foundation of a successful real estate career begins with cultivating a robust network of contacts, clients, and industry partners. In today’s interconnected world, leveraging digital platforms to expand reach is crucial. Social media, for instance, offers an unparalleled avenue for building brand recognition and engaging with potential buyers and sellers. By creating informative content, sharing market insights, and maintaining an active presence online, agents can establish credibility and foster trust. Moreover, virtual networking tools such as LinkedIn or online real estate communities allow agents to connect with professionals across the globe, opening doors to collaborations and referrals. A strong network is not just about quantity; it is about quality—cultivating relationships that are mutually beneficial and long-lasting.

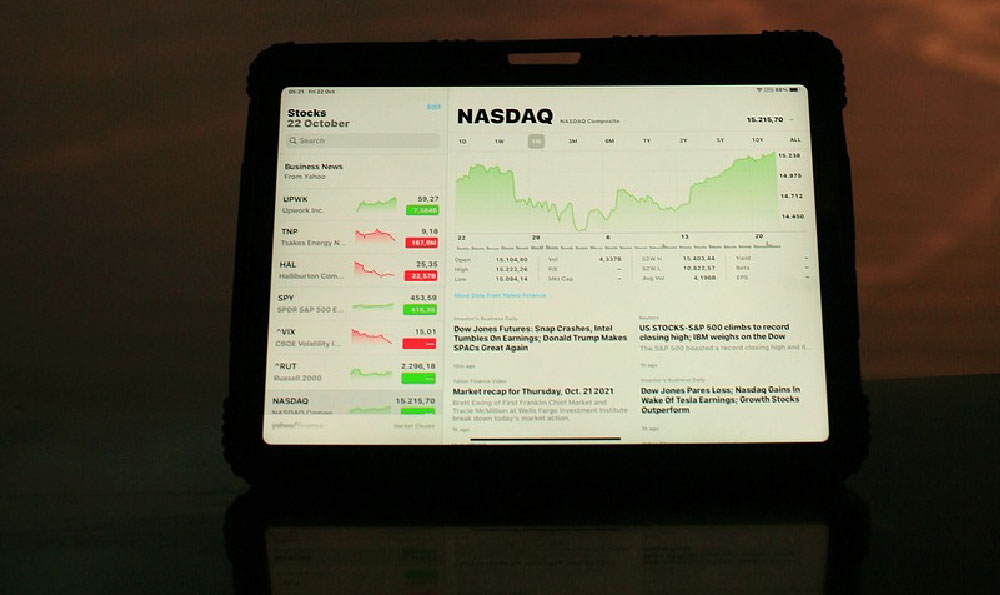

Mastering market trends requires a continuous analysis of both macroeconomic indicators and local real estate data. In recent years, technological advancements have reshaped how agents interpret and respond to these trends. For example, data analytics platforms now enable agents to track property values, demand patterns, and market saturation in real-time. By leveraging such tools, agents can make informed decisions about which areas to focus on, what types of properties to market, and when to sell or hold. Additionally, understanding the impact of global events—such as economic recessions, policy reforms, or demographic shifts—can provide a competitive edge. Agents who stay ahead of these trends are better positioned to anticipate changes and adjust their strategies accordingly.

Technology also plays a pivotal role in streamlining operations and improving efficiency. Real estate agents who adopt digital tools such as virtual tours, online listing platforms, and blockchain-based transaction systems can significantly reduce overhead costs and enhance the client experience. Virtual reality (VR) technology, for instance, allows clients to explore properties remotely, saving time and resources while expanding the pool of potential buyers. Blockchain, with its immutable ledger, promises greater transparency in property transactions, reducing fraud and streamlining the closing process. By embracing these technologies, agents can not only improve their productivity but also attract a new generation of clients who value innovation and convenience.

Investing in real estate is inherently tied to capital allocation and portfolio diversification. Traditional methods often involve leveraging funds, negotiating deals, and managing properties, but the integration of digital assets can unlock new avenues for growth. For instance, some agents are exploring the use of cryptocurrencies to facilitate transactions, particularly in markets where traditional payment methods may be limited. Additionally, tokens representing property ownership or rental agreements are emerging as a novel investment vehicle, allowing agents to offer fractional ownership to investors and diversify their clientele. These digital innovations not only provide liquidity but also attract a diverse range of investors, including those interested in alternative assets.

Risk management is a cornerstone of sustainable success. While the real estate market offers long-term growth potential, it is also fraught with uncertainties such as market downturns, regulatory changes, or economic volatility. A savvy agent navigates these risks by adopting a diversified investment strategy, ensuring that their portfolio is not overly exposed to any single market or area. For example, investing in both residential and commercial properties can hedge against sector-specific downturns. Moreover, incorporating digital tools such as automated property management systems or AI-driven market prediction models can help agents make more data-informed decisions, reducing reliance on intuition alone.

The interplay between traditional real estate and digital assets is becoming increasingly pronounced. For agents who wish to stay ahead of the curve, the key is to recognize that technology is not a replacement for expertise but a multiplier. By integrating digital assets into their business model—whether through offering cryptocurrency-based transactions, leveraging blockchain for transparency, or diversifying investments through tokens—they can unlock new revenue streams while mitigating risks. In doing so, agents not only adapt to the changing times but also position themselves as pioneers in an evolving industry.

As the real estate sector continues to evolve, the agents who succeed are those who embrace innovation, stay informed, and think strategically. Whether through digital tools that enhance efficiency, market trends that inform decisions, or investment strategies that diversify risk, the path to profitability is paved with adaptability. By viewing digital assets not as a separate entity but as an integral component of their business, agents can unlock unprecedented opportunities for growth and financial stability. With a foundation built on expertise, a network strengthened through technology, and a strategy refined by data and insight, success in real estate is no longer a question of luck but a matter of preparation and vision. The future belongs to those who are willing to evolve alongside it.