As an 11-year-old, the concept of generating income may seem distant, yet many young individuals have discovered creative and manageable ways to earn money at home. These opportunities not only provide a sense of financial independence but also serve as valuable lessons in responsibility, resourcefulness, and basic financial management. While the methods vary by individual interests and local circumstances, they often revolve around leveraging personal skills, familial resources, and the growing world of digital platforms. The key lies in identifying activities that align with the child’s abilities, time availability, and the practicality of execution.

One straightforward approach involves contributing to household responsibilities. Many families assign chores to children such as cleaning the room, organizing toys, or helping with meal preparation, and in exchange, offer a small allowance. By setting clear expectations and rewarding consistent effort, this practice fosters a sense of ownership over family finances. For instance, a child could be tasked with managing a simple budget for household items, tracking expenses, and suggesting cost-effective alternatives. Such activities not only teach the value of money but also encourage strategic thinking about how resources are allocated. Additionally, older siblings or parents might involve the child in managing small expenses, like purchasing groceries or planning a family outing, thus integrating them into the broader framework of financial decision-making.

Another avenue is to monetize personal talents or hobbies. Whether it’s drawing, crafting, playing an instrument, or excelling in a particular sport, children can sell their creations or services to friends, neighbors, or online platforms. For example, a student passionate about art might create custom greeting cards or decorate reusable shopping bags, which can be sold at local markets or through social media. Similarly, a tech-savvy child could learn basic coding to design a simple game or app, which can be shared on platforms like itch.io or distributed among peers. These activities require minimal initial investment but demand dedication and creativity. It’s important to guide the child in understanding the basics of pricing, marketing, and customer service, as these skills are transferable to more complex financial endeavors.

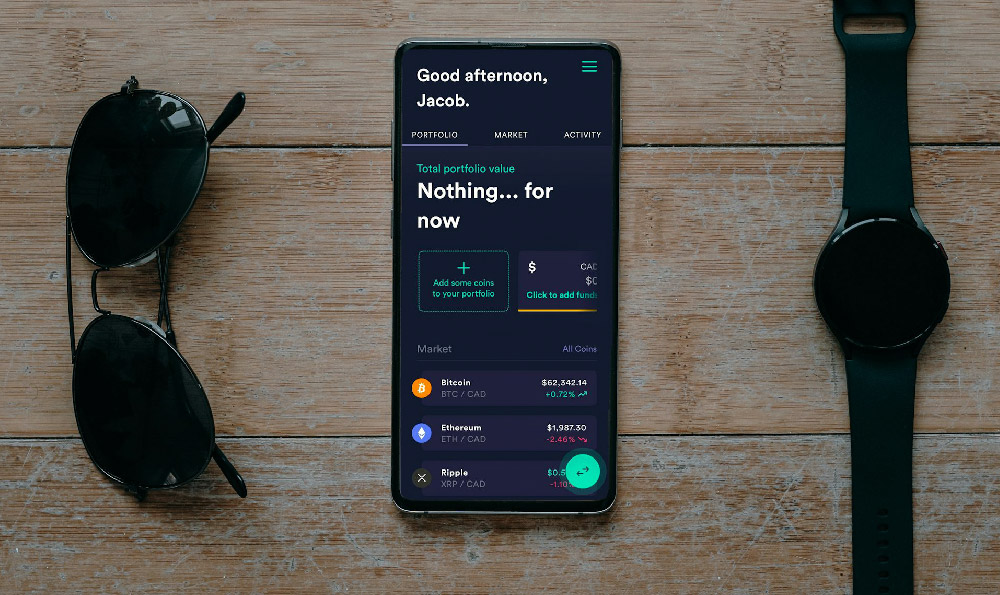

The rise of the digital age has also opened new possibilities for earning at home. Online platforms like YouTube, TikTok, or Instagram allow children to share content related to their interests, such as tutorials, art, or gaming footage, and earn income through ads or sponsorships. While this may involve longer hours and a degree of self-promotion, it can be a rewarding way to engage with a global audience. Additionally, the child might explore simple side gigs, such as creating digital products like printable worksheets, designing merchandise for online retailers, or offering virtual assistance to adults who need help with basic tasks. These activities require some parental oversight to ensure appropriate content and safety, but they provide an opportunity to learn about digital entrepreneurship.

Another strategy is to participate in remote or local projects that pay for their skills. For example, a child with a passion for animals might care for a neighbor’s pet while they are away, charging a small fee for the service. Alternatively, a student skilled in organizing or time management might assist with tasks like planning a family itinerary or managing a small budget for a school project, gaining hands-on experience in practical finance. Such opportunities are often rooted in the child’s ability to offer value to others, whether through labor, creativity, or knowledge. Parents can play a crucial role in facilitating these experiences by identifying community needs and encouraging the child to propose solutions.

In addition to these methods, the child might explore monetizing knowledge or experience through educational activities. For instance, they could create study guides or practice tests for younger siblings or classmates, offering these as a service for a nominal fee. Alternatively, they might tutor peers in subjects they excel in, such as math, science, or language learning, while earning income through a structured system. These activities not only help the child earn money but also reinforce their understanding of academic subjects and the importance of sharing knowledge. Parents can support this process by providing materials or creating a safe environment for the child to interact with others.

Ultimately, the most effective ways for an 11-year-old to earn money at home depend on their specific interests, time availability, and the family’s financial situation. The key is to approach these opportunities with a balanced perspective, ensuring that they are both safe and intellectually stimulating. By encouraging the child to set goals, track their progress, and understand the value of their work, parents can help them develop a foundation for long-term financial success. These early experiences in earning money, though modest, can shape the child’s mindset toward wealth creation and responsible management, preparing them for more complex financial decisions in the future.