Okay, here's an article addressing the query "How Can I Make Money, and Is Affiliate Marketing the Way?" Remember, I'm playing the role of a financial advisor here, so my tone is professional and focused on building long-term financial success.

The quest to generate income is a fundamental human endeavor, fueled by the desire for financial security, freedom, and the ability to pursue personal goals. There's no single magic bullet for making money; instead, a strategic and adaptable approach, coupled with diligent effort, is key. Before exploring specific avenues like affiliate marketing, it’s crucial to define your objectives and assess your resources. What are your financial goals? Are you aiming for supplemental income, a full-time replacement for your current job, or building a substantial nest egg? Understanding your goals will help you prioritize and focus your efforts. What skills and resources do you possess? Do you have expertise in a particular area, access to capital, or significant time to invest?

Several proven paths exist for wealth creation. One is through traditional employment, which provides a steady income stream, often accompanied by benefits like health insurance and retirement contributions. While this path may not offer the quickest route to riches, it provides stability and can be a solid foundation for building wealth over time, especially when coupled with disciplined saving and investment strategies.

Another is entrepreneurship. Starting your own business offers the potential for higher rewards, but it also comes with significant risks and requires substantial commitment, resilience, and a willingness to learn continuously. It’s crucial to develop a solid business plan, conduct thorough market research, and secure adequate funding before launching any venture. This path requires careful planning, execution, and a healthy appetite for risk.

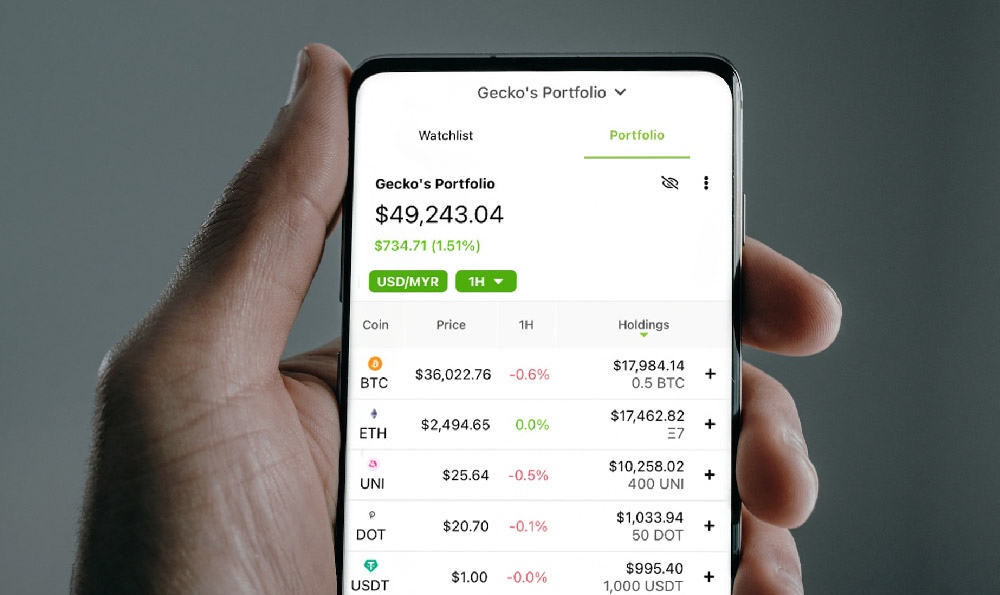

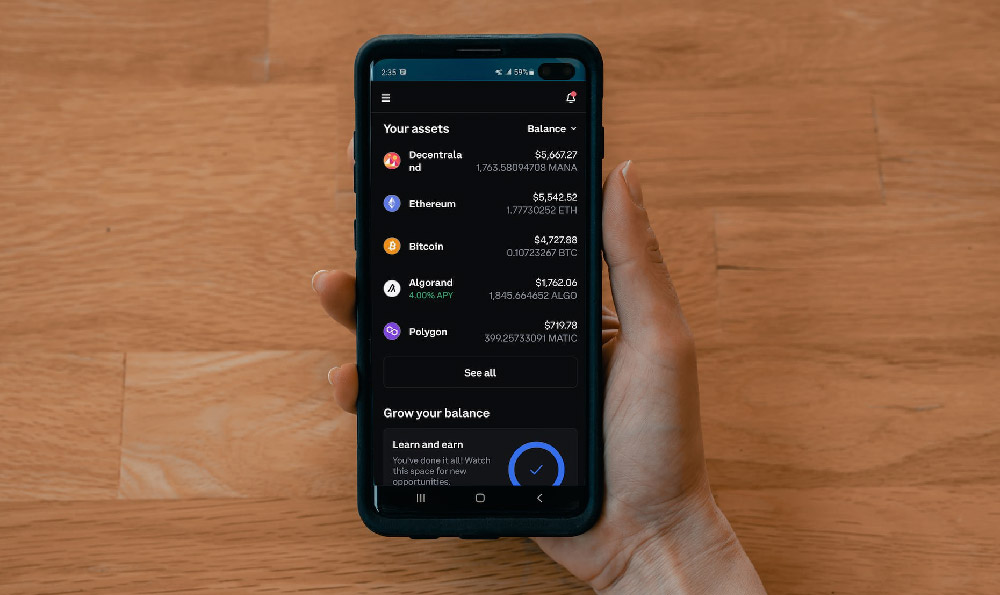

Investing in assets is also an important avenue. Real estate can provide rental income and potential appreciation in value, but it also requires significant capital investment and ongoing management. The stock market offers a diverse range of investment opportunities, from individual stocks to mutual funds and exchange-traded funds (ETFs), but it also involves inherent risks and requires a good understanding of financial markets and investment principles. It's crucial to diversify your portfolio and invest for the long term to mitigate risk and maximize potential returns. Investment in stocks is not a get rich quick solution.

Now, let's consider the specific question of affiliate marketing. Affiliate marketing involves partnering with businesses to promote their products or services and earning a commission on sales generated through your unique affiliate link. It can be a viable way to make money, particularly if you have a strong online presence, a niche audience, and the ability to create engaging content.

However, it's important to approach affiliate marketing with realistic expectations. Success in affiliate marketing requires effort, time, and a strategic approach. It's not a passive income stream; it requires active promotion, content creation, and audience engagement. You'll need to choose a niche that you're passionate about and that has a demand for the products or services you'll be promoting. Building trust with your audience is paramount. Promote products you genuinely believe in and that will benefit your audience. Overtly pushing low-quality products will erode your credibility and damage your long-term prospects.

Creating high-quality content is also essential. This can include blog posts, articles, videos, social media updates, or email newsletters. Your content should be informative, engaging, and relevant to your audience. Use various promotional methods like social media marketing, email marketing, search engine optimization (SEO), and paid advertising to drive traffic to your affiliate links.

Affiliate marketing can be lucrative, but you'll need to master skills like SEO, copywriting, and social media marketing. The landscape is also constantly changing, requiring you to stay updated on the latest trends and best practices. Moreover, competition in the affiliate marketing space can be fierce. Many individuals are pursuing similar opportunities, which means you'll need to differentiate yourself through high-quality content, targeted marketing, and a strong understanding of your audience.

Before diving into affiliate marketing, consider these factors:

- Your Existing Audience: Do you already have an online presence, such as a blog, social media following, or email list? This will give you a head start in reaching potential customers.

- Your Niche Expertise: Are you knowledgeable and passionate about a specific topic? This will allow you to create more authentic and engaging content.

- Your Time Commitment: Are you willing to invest the time and effort required to create content, promote products, and engage with your audience?

- Your Financial Resources: While affiliate marketing can be started with minimal capital, you may need to invest in tools, software, or advertising to scale your efforts.

Ultimately, whether affiliate marketing is the "way" for you depends on your individual circumstances, skills, and goals. It can be a viable option, but it's not a guaranteed path to riches. Consider it a long-term game that requires sustained effort and a willingness to adapt to changing market conditions.

Instead of viewing affiliate marketing as a standalone solution, consider integrating it into a broader financial plan. This might involve combining affiliate marketing with other income streams, such as freelance work, part-time employment, or investments. Creating multiple income streams can provide greater financial security and flexibility.

Finally, continuous learning is paramount in the world of finance and online marketing. Stay up-to-date on the latest trends, technologies, and best practices. Invest in your own education through online courses, books, and mentorship programs. The more you learn, the better equipped you'll be to make informed decisions and achieve your financial goals. Making money is not about finding a single trick; it's about developing a long-term strategy that aligns with your values, skills, and goals, while continually adapting to the ever-changing economic landscape.