Unlocking opportunities to generate income through mobile apps is no longer a distant dream but a viable strategy that blends innovation with practical financial planning. As smartphones become the primary gateway to digital economies, the landscape of app-based earning has expanded exponentially, offering diverse avenues ranging from passive income streams to active investment strategies. However, navigating this terrain requires a nuanced understanding of both the tools at your disposal and the underlying risks that accompany them. By adopting a proactive and informed approach, individuals can transform their mobile devices into powerful instruments for financial growth.

The foundation of app-driven income lies in identifying platforms that align with your skills, interests, and time availability. Freelancer platforms like Upwork or Fiverr serve as digital marketplaces where professionals can monetize their expertise in graphic design, writing, programming, or video editing. These apps function as intermediaries between clients seeking specialized services and freelancers offering their talents, often through flexible project-based or hourly-rate models. The allure of these platforms stems from their global reach, enabling users to collaborate with clients across different time zones and geographical regions. While the potential earnings vary depending on the niche and experience level, the key to success remains consistent deliverables, competitive pricing, and a robust portfolio. For instance, a skilled app developer can command substantial fees for custom software solutions, while content creators can generate income through high-quality tutorials or services.

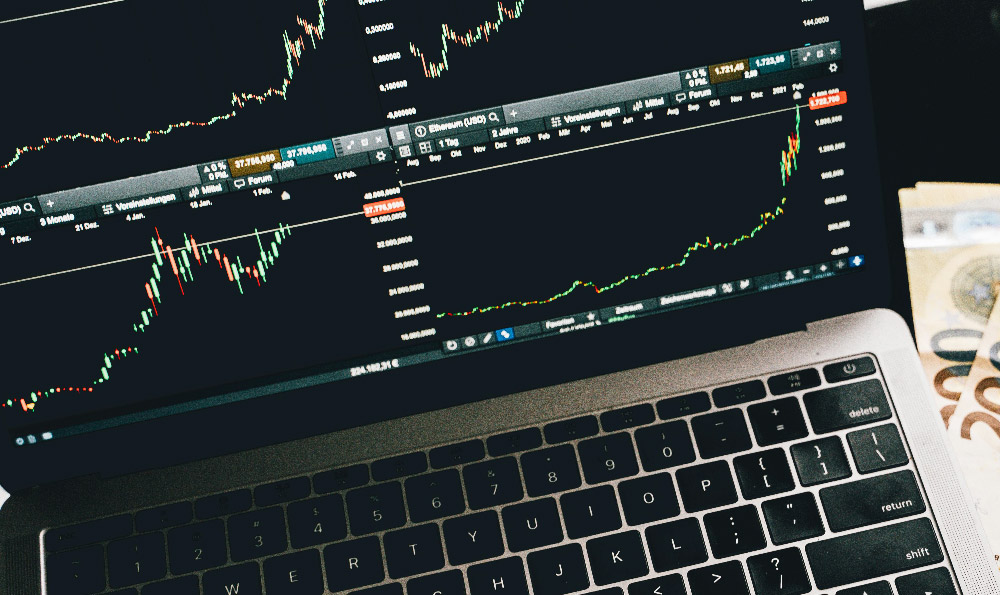

In the realm of digital investments, mobile apps have become essential tools for managing and profiting from crypto assets. Platforms such as Coinbase, Binance, and Kraken provide users with the ability to trade cryptocurrencies, set up staking accounts, and explore yield farming opportunities directly from their smartphones. These apps often integrate advanced features like real-time market data, customizable trading alerts, and automated portfolio management, allowing investors to make informed decisions even when on the go. The appeal of crypto investments is their potential for high returns, but this comes with significant volatility and regulatory uncertainties. Educated investors understand the importance of analyzing technical indicators—such as moving averages, RSI (Relative Strength Index), and Bollinger Bands—while also diversifying their portfolios to mitigate risk. For example, a user might allocate funds across established cryptocurrencies like Bitcoin and Ethereum, while also exploring promising altcoins through carefully curated investment strategies.

Monetization through content creation has become another transformative avenue, particularly with social media platforms and app-specific ecosystems. Apps like YouTube, TikTok, and Instagram have evolved into powerful tools for cultivating audiences and monetizing creativity. Content creators can leverage these platforms by generating views, engagement, or subscriptions, which then translate into ad revenue, brand partnerships, or affiliate marketing income. The potential for growth is vast, with top creators reporting monthly earnings in the tens of thousands of dollars. However, success in this domain demands consistency, originality, and a deep understanding of audience preferences. For instance, a user might produce educational content on virtual currency trading, attracting a niche audience that values both entertainment and financial knowledge, which can then be monetized through sponsored posts or affiliate links.

Passive income opportunities through mobile apps often stem from the ability to generate value consistently with minimal ongoing effort. Subscription-based models, such as those offered by streaming services like Netflix or Spotify, allow users to benefit from recurring revenue streams by creating content that resonates with audiences. Similarly, apps like Google AdSense or similar platforms provide website owners with the potential to earn income by displaying targeted advertisements. The key to maximizing these opportunities lies in creating high-quality, engaging content that maintains user interest over time. For example, a user running a niche blog app on topics like personal finance or cryptocurrency can generate income through ad impressions, affiliate marketing, and reader contributions.

Strategic risk management is a critical component of any app-based earning endeavor. Whether you're investing in digital assets or monetizing content, the importance of diversifying your income sources cannot be overstated. This could involve allocating funds across different industries, platforms, or types of investments to prevent overexposure to market fluctuations. Additionally, the security of your financial data and digital assets should always be a priority, necessitating the use of multi-factor authentication, encrypted wallets, and secure app storage solutions. For instance, while exploring crypto investment opportunities, users can distribute their investments across multiple wallets and exchanges, reducing the potential impact of a single platform's security breach.

The journey to earning money through mobile apps is dynamic and ever-evolving. As new technologies emerge and existing platforms refine their offerings, the potential for innovation and income generation continues to expand. However, the path to success is not without its challenges. Individuals must remain vigilant, continuously adapt to changing market conditions, and prioritize long-term growth over short-term gains. By combining a deep understanding of technological trends with sound financial principles, the digital landscape can become a fertile ground for both financial stability and economic advancement.