Embarking on the journey to financial independence and wealth creation can feel overwhelming, but it’s a path accessible to everyone willing to learn and put in the effort. The question of how to earn money and where to begin is fundamental, and the answer lies in a combination of self-assessment, opportunity exploration, and disciplined financial planning.

The initial step is understanding your current financial landscape. This involves a detailed assessment of your income, expenses, assets, and liabilities. Creating a budget is crucial. It’s not just about restricting spending, but about understanding where your money goes each month. Many apps and tools are available to help track your spending and categorize expenses. This insight is invaluable for identifying areas where you can cut back and free up funds for investing. Simultaneously, take stock of your skills and passions. What are you good at? What do you enjoy doing? The intersection of these two often points towards potential income streams, whether through freelancing, consulting, or starting a side business.

Once you have a clear picture of your financial situation and your capabilities, you can start exploring different avenues for earning money. These can be broadly categorized into active income and passive income. Active income involves trading your time and effort for money, while passive income generates revenue with minimal ongoing effort, though it often requires an initial investment of time and/or capital.

For active income, consider opportunities that leverage your existing skills. If you're proficient in writing, offer freelance writing services. If you're knowledgeable about a particular subject, consider tutoring. Online platforms like Upwork, Fiverr, and LinkedIn provide access to a vast pool of potential clients. Furthermore, consider roles within the gig economy such as driving for ride-sharing services or delivering food. While these may not be long-term solutions, they can provide a valuable source of immediate income. Enhancing your skills through online courses or certifications can also significantly increase your earning potential in your current or desired field. Look for opportunities to learn in-demand skills like data analysis, digital marketing, or project management.

Turning your attention to passive income, this often requires an initial investment, either in terms of money or time. One popular option is investing in dividend-paying stocks. Dividends are portions of a company's profits distributed to shareholders. By investing in companies with a history of consistent dividend payments, you can generate a steady stream of income. Thorough research is essential; understand the company's financial health, industry trends, and dividend payout history before investing. Real estate is another potential source of passive income. Renting out a property can provide a recurring income stream. However, real estate investing also involves significant upfront costs, ongoing maintenance expenses, and potential periods of vacancy. Careful planning and due diligence are critical. Creating and selling online courses or ebooks is another avenue for passive income. If you have expertise in a particular area, you can share your knowledge with others and generate revenue from sales. This requires an initial investment of time in creating the content, but once it's done, it can generate passive income for years to come. Consider affiliate marketing, where you promote other companies' products or services and earn a commission on each sale made through your unique referral link. This requires building an audience and creating content that promotes the products or services, but it can be a lucrative source of passive income.

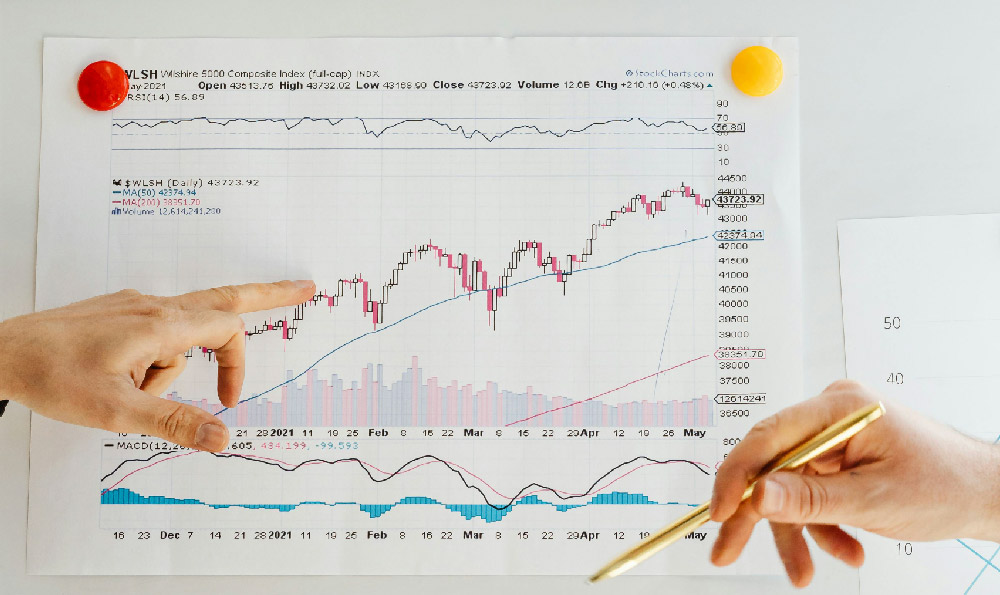

Having explored income opportunities, the next critical step is deciding where to allocate your savings and investments. This is where a sound investment strategy becomes essential. The optimal investment strategy depends on several factors, including your risk tolerance, time horizon, and financial goals. Generally, younger individuals with a longer time horizon can afford to take on more risk, while older individuals nearing retirement may prefer a more conservative approach.

Diversification is paramount. Don’t put all your eggs in one basket. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help reduce risk. Within each asset class, diversify further. For example, within stocks, invest in companies from different industries and geographies. For beginners, consider low-cost index funds or Exchange Traded Funds (ETFs). These funds track a specific market index, such as the S&P 500, and provide broad market exposure at a low cost. They are a simple and effective way to diversify your portfolio. Bonds are generally considered less risky than stocks, but they also offer lower returns. They can provide stability to your portfolio and act as a hedge against stock market volatility.

Regardless of your chosen investment strategy, it's crucial to be disciplined and consistent. Develop a habit of saving and investing regularly, even if it's just a small amount. Automate your savings by setting up automatic transfers from your checking account to your investment account. This removes the temptation to spend the money and ensures that you consistently invest. Regularly review and rebalance your portfolio to ensure that it remains aligned with your risk tolerance and financial goals. As your circumstances change, you may need to adjust your investment strategy. Don't make emotional investment decisions based on short-term market fluctuations. Stick to your long-term plan and avoid the temptation to buy high and sell low.

Finally, continuous learning is key. The financial world is constantly evolving, so it's important to stay informed about market trends, new investment products, and changes in regulations. Read financial news, attend webinars, and consult with a financial advisor to stay up-to-date. There are numerous resources available to help you learn about personal finance and investing, including books, websites, and online courses.

Earning money and building wealth is a journey that requires patience, discipline, and a willingness to learn. By understanding your financial situation, exploring income opportunities, developing a sound investment strategy, and staying informed, you can achieve your financial goals and build a secure future. Remember that even small steps taken consistently over time can lead to significant results.