The allure of earning money quickly, even seemingly "for free," is a powerful one. The desire for rapid wealth accumulation is deeply ingrained in human nature. However, a realistic assessment reveals that sustainable, ethical, and truly "free" pathways to significant income are rare and usually require an investment of time, skill, or resources, even if not direct monetary capital. Let's dissect the concept of "earning money fast" and explore the possibilities, while maintaining a healthy dose of skepticism.

The phrase "earning money fast" immediately conjures up images of overnight successes, lottery wins, or risky investments. While these outcomes are theoretically possible, they are statistically improbable and often carry significant downsides. Relying solely on such strategies is akin to gambling – a gamble with your financial future. Instead, a more pragmatic approach involves identifying opportunities that offer a faster-than-average return, acknowledging the inherent risks involved, and managing those risks effectively.

Several legitimate avenues can lead to quicker income generation, but none are truly "free" in the sense of requiring zero effort or input. For example, participating in online surveys or completing micro-tasks on platforms like Amazon Mechanical Turk can generate small amounts of money relatively quickly. However, the hourly rate is typically low, and it requires a significant time commitment to accumulate any substantial sum. Similarly, utilizing cashback apps and rewards programs can offer savings and even small payouts, but these are more about optimizing existing spending than generating entirely new income streams. These methods are useful for supplementing income, not fundamentally changing one's financial standing.

Freelancing presents a more promising path toward earning money faster. Individuals with in-demand skills like writing, graphic design, web development, or digital marketing can offer their services on platforms like Upwork, Fiverr, or Toptal. The speed at which you can earn money depends on your skill level, demand for your services, and your ability to market yourself effectively. While freelancing doesn't require upfront monetary investment (beyond perhaps a computer and internet access), it demands a significant investment of time and effort in honing your skills, building a portfolio, and actively seeking out clients. Furthermore, establishing a strong reputation and securing consistent work takes time and dedication.

Another avenue often touted for quick income is participating in the "gig economy" – driving for ride-sharing services like Uber or Lyft, delivering food through platforms like DoorDash or Grubhub, or offering handyman services through TaskRabbit. These gigs offer flexibility and can provide immediate income, but they also come with their own set of costs and considerations. You need a reliable vehicle (which depreciates in value and requires maintenance), incur fuel expenses, and potentially face unpredictable earnings depending on demand and competition. These factors significantly impact the actual profitability of these endeavors. Moreover, the "free" aspect is misleading, as the wear and tear on your vehicle represents a hidden cost that must be factored into your overall earnings.

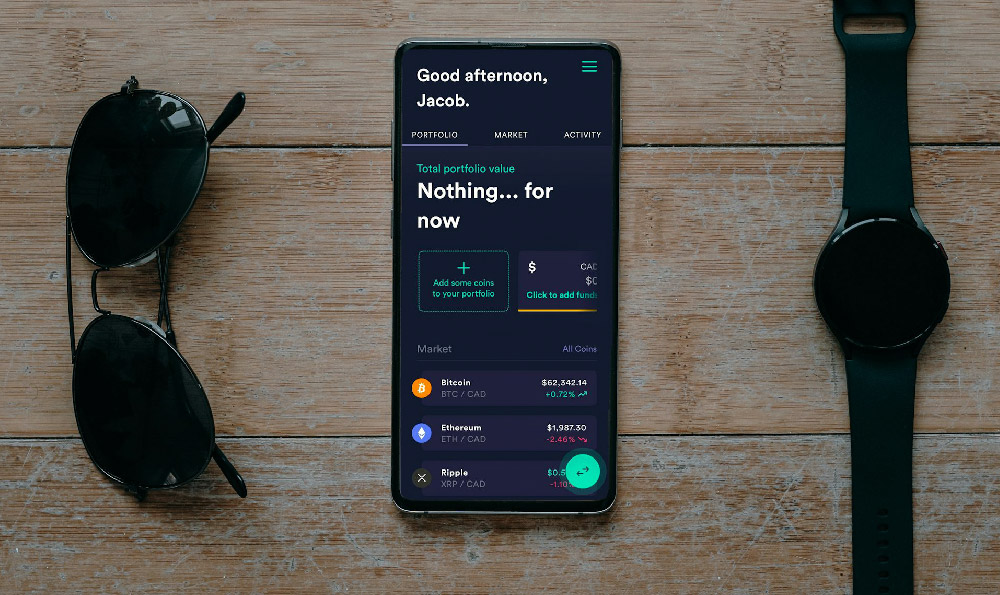

Turning to the realm of investments, the potential for rapid gains is undeniable, but so is the potential for substantial losses. Day trading, for instance, involves buying and selling securities within the same day, aiming to profit from short-term price fluctuations. While some individuals have achieved success through day trading, it requires a deep understanding of market dynamics, technical analysis, and risk management. It is inherently speculative and unsuitable for novice investors. Similarly, investing in volatile assets like cryptocurrencies can offer the potential for rapid gains, but also exposes you to the risk of significant losses due to market volatility and regulatory uncertainty. It is crucial to conduct thorough research and only invest what you can afford to lose.

Creating and selling digital products, such as online courses, ebooks, or software, represents another potential pathway to generating income. While the initial investment might be minimal (depending on the complexity of the product), the success of this venture hinges on identifying a niche market, creating high-quality content, and effectively marketing your product. This requires a significant investment of time, effort, and marketing expertise. Furthermore, competition in the digital product space is fierce, and it takes consistent effort to stand out from the crowd.

Ultimately, the concept of "getting paid for free" is largely a myth. All forms of income generation require some form of investment, whether it's time, effort, skill, or capital. The key to earning money faster lies in identifying opportunities that align with your skills and interests, developing a solid plan, and managing your risks effectively. Focusing on building valuable skills, providing in-demand services, and making informed investment decisions are the cornerstones of long-term financial success. While the promise of quick riches is tempting, a more realistic and sustainable approach is to focus on building a solid financial foundation through hard work, diligence, and smart financial planning. The pursuit of wealth should not be at the expense of sound judgment and ethical practices. Therefore, carefully evaluate any opportunity that promises rapid or effortless income and remember that if it sounds too good to be true, it probably is.