Cryptocurrency has emerged as a transformative force in the realm of digital finance, offering both unprecedented opportunities and significant risks. While the allure of quick riches is tempting, it is essential to approach this dynamic market with a strategic mindset, informed by thorough research and disciplined execution. For those seeking to harness the potential of online money generation through virtual currencies, the path requires a balance between innovation and caution. This article explores actionable strategies that align with both financial growth and risk mitigation, emphasizing the importance of informed decision-making in a volatile landscape.

Understanding the fundamentals of cryptocurrency markets is the first step toward navigating them effectively. The value of digital assets is driven by a combination of factors, including technological advancements, regulatory developments, market sentiment, and macroeconomic trends. For instance, the adoption of blockchain technology in industries beyond finance—such as supply chain management and healthcare—can create long-term value for certain tokens. Similarly, government policies, such as the introduction of central bank digital currencies (CBDCs), may influence the demand for existing cryptocurrencies. By staying attuned to these macro-level drivers, investors can position themselves to anticipate shifts in the market and make more informed decisions.

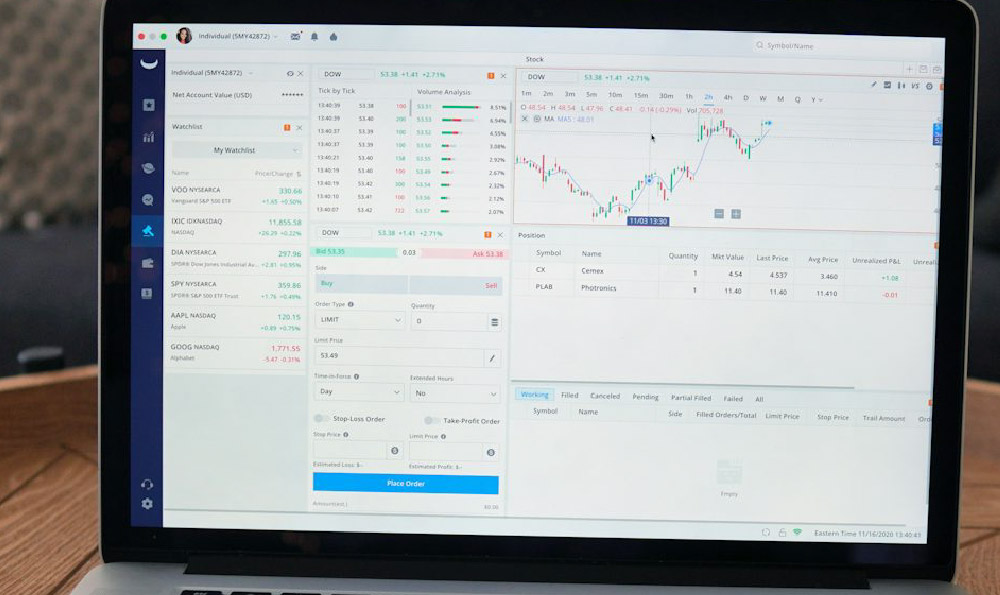

Technical analysis plays a critical role in interpreting price movements and identifying potential entry and exit points. Tools like candlestick charts, moving averages, and volume indicators help investors visualize trends and make data-driven decisions. A key principle in technical analysis is the concept of "support and resistance," which refers to price levels where buying and selling pressure is likely to change direction. For example, if a cryptocurrency repeatedly bounces off a specific price point, this could indicate a psychological support level, while a price that struggles to break through a certain threshold might suggest a resistance level. By mastering these techniques, investors can uncover patterns that may not be immediately apparent through fundamental analysis alone.

Risk management is an integral component of successful cryptocurrency investing. Unlike traditional finance, where losses can erode portfolios gradually, the crypto market is known for its high volatility. A single day's price swing can result in substantial gains or losses, making it crucial to implement strategies that protect capital. Diversification is one of the most effective risk mitigation tools, but it must be done with a clear understanding of the underlying assets. Investors should avoid over-concentrating their holdings in a single coin, as market crashes or regulatory actions can create systemic risks. Instead, spreading investments across different asset classes—such as stablecoins, utility tokens, and security tokens—can help minimize exposure to any one event.

Education is the cornerstone of sustainable wealth creation in the crypto space. With the rapid evolution of blockchain technology and the emergence of new projects, staying informed is not just beneficial but essential. Investors should dedicate time to understanding the core principles of blockchain, including consensus mechanisms, smart contracts, and decentralization. Knowledge of these concepts allows for a more nuanced evaluation of projects, distinguishing between those with genuine innovation and those that are little more than speculative ventures. Additionally, keeping abreast of industry developments, such as the rise of decentralized finance (DeFi) protocols or the integration of non-fungible tokens (NFTs) with traditional markets, can uncover emerging opportunities that align with long-term investment goals.

The concept of passive income through cryptocurrency is gaining traction, particularly with the growth of yield farming and staking. Many blockchain networks reward users for participating in consensus processes, allowing them to earn interest on their holdings. For example, staking Ethereum offers a return on investment through block rewards, while yield farming on DeFi platforms provides additional incentives by offering liquidity provision rewards. However, it is important to note that these strategies come with their own set of risks, including impermanent loss and smart contract vulnerabilities. Investors should carefully evaluate the risks and rewards associated with each opportunity before committing funds.

Innovative platforms and tools are reshaping the way investors approach cryptocurrency. Automated trading algorithms, for instance, can execute trades based on predefined criteria, reducing the emotional aspect of decision-making. However, these systems are not foolproof and should be used with a deep understanding of their mechanics. Investors should also explore fractional ownership models, which allow them to invest in high-value assets with smaller capital outlay. While these approaches can enhance accessibility, they require careful selection of platforms and a clear understanding of the associated risks.

The key to successful cryptocurrency investing lies in combining strategic foresight with disciplined execution. While the market offers opportunities for rapid wealth creation, it is important to recognize that sustainable growth typically requires patience and research. Investors should focus on long-term value rather than short-term gains, avoiding the pitfalls of speculative trading. By adopting a balanced approach that integrates market analysis, technical insights, and risk management, individuals can navigate the complexities of cryptocurrency and build a resilient investment portfolio. Ultimately, the path to financial growth through virtual currencies is not about chasing quick returns, but about cultivating a comprehensive understanding of the market and leveraging that knowledge to make informed decisions.