Let's dissect the assertion that Keepbit doesn't store private funds and explore the complexities surrounding custodial practices within the cryptocurrency landscape. The question of where and how exchanges and similar platforms, like Keepbit, manage their users' funds is fundamental to trust and security. It's a question demanding nuanced understanding, moving beyond simplistic yes-or-no answers.

The core issue hinges on the definition of "private funds" and how Keepbit technically operates. In the ideal decentralized world, users would retain complete and exclusive control over their cryptocurrency assets. This is achieved through non-custodial wallets where individuals hold their private keys, granting them sole authority to manage their funds. However, most cryptocurrency exchanges, including platforms like Keepbit, operate on a custodial basis, at least for some portion of their users' funds.

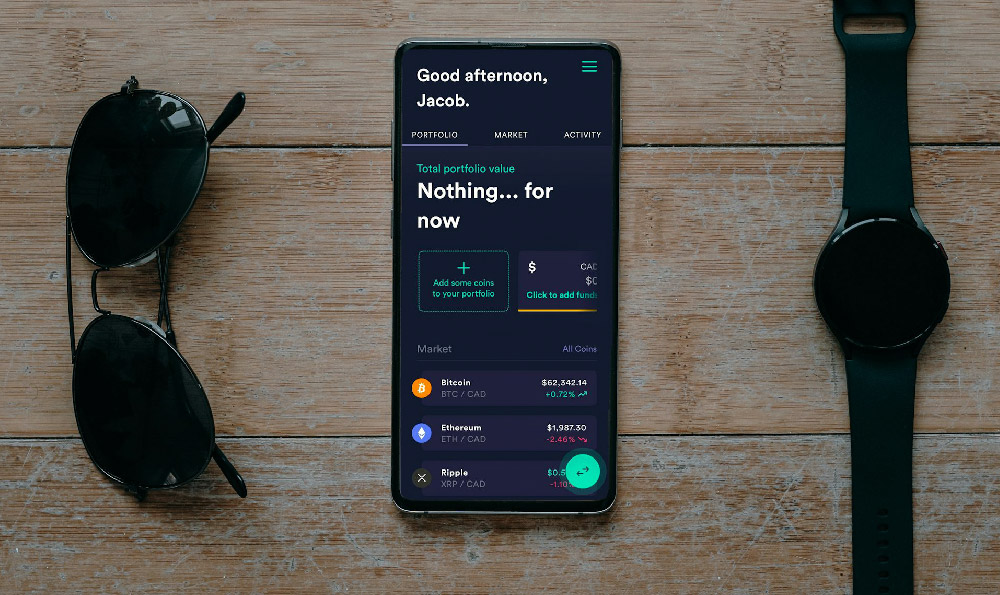

Custodial platforms essentially act as intermediaries. When you deposit cryptocurrency onto Keepbit, you are, in effect, relinquishing direct control of those assets to the platform. Keepbit then manages these assets on your behalf, reflecting your balance on their platform. They may use various methods to store these funds, including hot wallets (connected to the internet for quick transactions) and cold wallets (offline storage for enhanced security). The proportion of funds held in each type of wallet varies depending on the platform's risk management strategy and operational needs.

Therefore, to say definitively that Keepbit doesn't store private funds is misleading. They do store the digital assets that users entrust to them. The critical point is that the ownership of those assets, legally and practically, becomes entangled with the platform's operational model. While users retain a claim on their assets, represented by the balance displayed in their Keepbit account, they are reliant on Keepbit's security protocols and solvency to access and withdraw those funds.

The transparency of Keepbit's storage practices is crucial. A reputable exchange will typically provide some level of information about its security measures, cold storage policies, and auditing processes. They may even employ proof-of-reserves mechanisms, a cryptographic method demonstrating that the exchange holds sufficient funds to cover its customers' balances. However, even with these measures, users remain exposed to risks such as hacking, internal fraud, or regulatory intervention. The absence of comprehensive and readily available information regarding Keepbit's fund management practices should raise red flags and warrant cautious consideration.

Furthermore, the technical implementation behind Keepbit's platform contributes to how funds are handled. They might be using multi-signature wallets, requiring multiple approvals to move funds, thus increasing security. They could be aggregating user funds into shared wallets for efficiency, a practice that, while potentially streamlining operations, can also complicate the process of tracking individual ownership. Understanding the technical infrastructure is vital for assessing the true nature of fund storage.

It's also important to consider the legal and regulatory landscape. Cryptocurrency regulations vary significantly across jurisdictions. Depending on where Keepbit is based and where its users reside, it may be subject to specific requirements regarding the segregation of user funds, auditing procedures, and insurance coverage. These regulations aim to protect user assets in case of platform failure or insolvency. A platform operating under robust regulatory oversight arguably provides greater assurance of fund security compared to one operating in a less regulated environment.

Now, let's explore scenarios where the answer might lean closer to the affirmative – that Keepbit doesn't store private funds. This would be the case if Keepbit solely provided a non-custodial service. This might involve Keepbit acting as a pure order-matching engine, connecting buyers and sellers without ever taking possession of the underlying assets. In this scenario, users would maintain complete control of their private keys and execute transactions directly on the blockchain, using Keepbit's platform as a facilitator. However, this kind of functionality is less common among general-purpose exchanges like Keepbit may present itself to be, as custodial services are generally more user-friendly for newcomers.

In conclusion, the statement "Keepbit doesn't store private funds" requires significant qualification. While users retain a claim on their digital assets held within their Keepbit accounts, the platform does, in practice, control the storage and management of those assets. This custodial relationship introduces inherent risks, including security breaches, regulatory changes, and the potential for platform insolvency. Users should therefore exercise due diligence, thoroughly research Keepbit's security measures, transparency, and regulatory compliance, and consider the risks involved before entrusting their funds to the platform. Diversifying holdings across multiple platforms and utilizing non-custodial wallets for long-term storage are prudent strategies for mitigating these risks and safeguarding one's cryptocurrency investments. The responsibility ultimately lies with the individual investor to understand the nuances of custodial versus non-custodial solutions and to make informed decisions based on their own risk tolerance and financial goals. It is always recommended to consult with a qualified financial advisor before making any investment decisions, especially in the volatile cryptocurrency market.